Securing a loan can sometimes feel like an arduous task, especially if your financial health isn’t in its best shape. One critical factor that significantly impacts your loan approval odds is your CIBIL score. The Credit Information Bureau (India) Limited, often known as CIBIL, assigns a numerical score that reflects your creditworthiness. This score is instrumental for lenders in making lending decisions. Hence, improving your CIBIL score can make the difference between approval and rejection when it comes to your loan application.

In this comprehensive guide, we will delve into what a CIBIL score is, why it matters, and actionable steps you can take to improve it for better loan approval. Also, we will touch on how to manage your finances through CIBIL login and tapping into their resources.

Understanding CIBIL Score

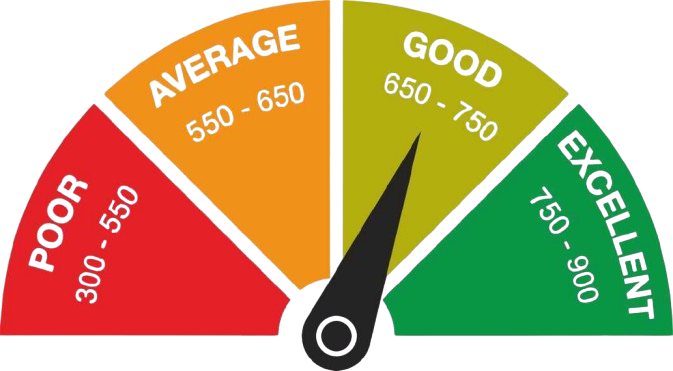

A CIBIL score is a three-digit number ranging from 300 to 900. This score is derived from an individual’s credit history across various credit institutions over a period. A high CIBIL score signifies a strong credit history and responsible credit behavior, thereby making you a more attractive candidate to lenders. Conversely, a low CIBIL score can diminish your chances of availing loans or can result in less favorable loan terms and higher interest rates.

Lenders often view a CIBIL score above 750 as optimal. Scores below this threshold can be considered risky, necessitating the need to improve your standing if it falls short.

Actionable Steps to Improve Your CIBIL Score

Improving your CIBIL score involves a series of well-thought-out financial habits. Let’s explore some actionable steps:

1. Make Timely Payments

The significance of making timely repayments cannot be stressed enough. Whether it’s a credit card bill, loan EMI, or any form of credit, ensure that payments are made on or before the due date. The payment history accounts for a considerable portion of your credit score calculation. Set up reminders or automate payments to avoid missing deadlines.

2. Monitor Your Credit Report Regularly

One of the best ways to stay ahead in managing your credit score is by frequently checking your CIBIL report via CIBIL login. This allows you to identify any discrepancies or errors, such as incorrect personal information or wrongly attributed late payments, that might be dragging down your score. If you spot an error, report it immediately to the concerned institution for rectification.

3. Maintain a Healthy Credit Mix

Lenders prefer a balanced credit mix that includes both secured (home loans, car loans) and unsecured (credit cards, personal loans) credit. A diverse credit portfolio reflects your ability to manage different types of credit effectively, thereby boosting your CIBIL score.

4. Limit Your Credit Utilization Ratio

Credit Utilization Ratio (CUR) is the ratio of your credit card balance to your credit limit. A high CUR indicates heavy reliance on credit, which can negatively impact your CIBIL score. Aim to keep your credit utilization below 30% of your available credit limit. If you’re nearing this limit, consider requesting a credit limit increase or paying off some of your balance.

5. Avoid Multiple Credit Inquiries

Every time you apply for credit, lenders conduct a hard inquiry into your credit report. While one or two inquiries might not significantly affect your score, multiple inquiries in a short time can signal financial instability and reduce your CIBIL score. Be strategic about applying for new credit and only do so when absolutely necessary.

6. Clear Outstanding Dues

Old, outstanding dues can severely harm your credit report. Ensure that any pending payments are cleared, no matter how old they are. Clearing these may result in an immediate positive impact on your CIBIL score.

7. Keep Old Credit Cards Active

The age of your credit history is another critical factor influencing your CIBIL score. Older accounts contribute positively to this metric. Even if you no longer use an old credit card, keeping it active can help maintain a longer credit history, thereby benefiting your score.

8. Pay Off Debts, Not Just Minimums

Paying only the minimum due amount on your credit card can lead to a mounting debt due to high-interest rates. Always aim to pay off as much as possible, ideally the full amount due, to avoid interest accrual and improve your CIBIL score.

9. Opt for Longer Tenure Loans

Choosing longer tenure loans can help in reducing your monthly EMI burden, consistently paying off large amounts reduces financial strain and helps ensure timely payments, positively impacting your CIBIL score.

10. Educate Yourself

Knowledge is power. Take advantage of resources available on the CIBIL login portal to educate yourself about credit management and incorporate best practices in your financial habits.

Using CIBIL Login to Monitor and Manage Your Score

Registering on the CIBIL login portal should be a priority if you are serious about monitoring and improving your CIBIL score. Here, you can access detailed reports, keep track of changes, and understand the constituents of your score.

Steps for CIBIL Login:

1. Visit the official CIBIL website: Navigate to the CIBIL website and locate the CIBIL login option.

2. Register: If you are a new user, you will need to register by providing details such as personal information, identity proofs, and payment for report access.

3. Login: Once registered, use your credentials to log in.

4. Access Your Report: Navigate to view your credit report, which can be downloaded or viewed online.

5. Periodic Monitoring: Make it a habit to check your report periodically, at least once a quarter, to stay updated on your credit health.

Common Mistakes to Avoid

Even with the best intentions, some common pitfalls can sabotage your efforts to improve your CIBIL score. Here are a few to watch out for:

– Ignoring Errors: Assuming that your credit report is error-free can be a costly mistake. Always dispute inaccuracies promptly.

– Closing Old Accounts: As mentioned earlier, the length of your credit history matters. Closing old accounts can reduce the age of your credit history.

– Taking Unnecessary Loans: Applying for loans you don’t need can result in unnecessary hard inquiries, affecting your score negatively.

Conclusion

Your CIBIL score is a powerful determinant of your financial health and can significantly impact your ability to secure loans at favorable terms. Improving your score requires a disciplined approach to managing your finances, from making timely payments to maintaining a healthy credit mix and regularly monitoring your credit report through CIBIL login.

Making these practices a permanent part of your financial management strategy will not only help you improve your CIBIL score but also empower you with better control over your financial future. By staying informed and proactive, you increase your chances of loan approval, eventually facilitating a smoother and more favorable lending process.

Incorporate these steps diligently, and your improved CIBIL score will soon reflect your financial responsibility, opening the doors to better loan opportunities and a secure financial journey ahead.