The Buy Now, Pay Later (BNPL) market has grown exponentially, with apps like Klarna and Afterpay setting the standard for user convenience and accessibility. As businesses and developers strive to enter this lucrative sector, creating a user-friendly app is essential to stand out and retain users. In this article, we’ll explore key strategies to make your Buy Now Pay Later app development successful, engaging, and easy to use.

Why User Experience Matters in BNPL Apps

The modern consumer demands simplicity and efficiency. A user-friendly BNPL app not only ensures a seamless experience but also enhances customer trust and loyalty. Apps like Klarna and Afterpay prioritize user-centric design, making them leaders in the field.

Benefits of Prioritizing Usability

- Higher retention rates: A smooth interface keeps users coming back.

- Increased trust: Transparent and intuitive processes reduce user hesitation.

- Improved conversion rates: Simpler navigation encourages more purchases.

Key Features of a User-Friendly BNPL App

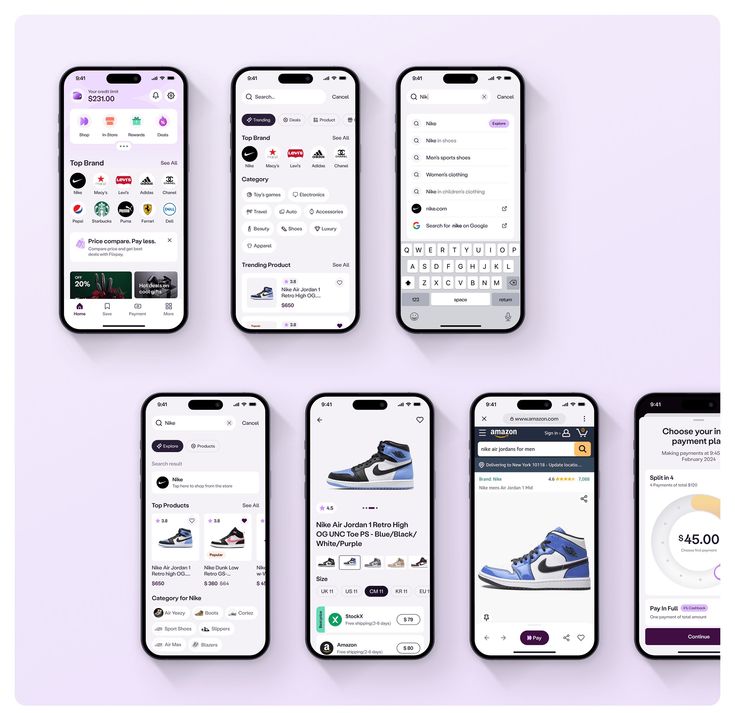

A successful BNPL app like Klarna or an Afterpay clone must incorporate essential features that cater to user convenience.

1. Simplified Onboarding Process

A lengthy or complicated sign-up process can deter potential users. Simplify onboarding by:

- Allowing users to sign up using their email, phone number, or social media accounts.

- Offering clear instructions and minimizing required fields.

- Implementing verification steps that are quick and secure.

2. Clear Payment Options

Transparency is crucial in a Buy Now Pay Later model. Your app should:

- Display all payment plans upfront, including installment schedules and due dates.

- Clearly show any interest, fees, or penalties.

- Provide a calculator for users to preview payment breakdowns.

3. Intuitive User Interface (UI)

Design plays a significant role in usability. Ensure your app’s UI:

- Features a clean, clutter-free layout with clear navigation.

- Uses simple language and icons that users can easily understand.

- Adapts seamlessly across devices (mobile, tablet, desktop).

Personalization and Customer Engagement

To succeed in Buy Now Pay Later app development, personalization and engagement are key differentiators.

1. Customized User Profiles

Allow users to tailor their profiles with preferences such as:

- Default payment methods.

- Notification settings for payment reminders.

- Saved merchants or favorite shopping categories.

2. AI-Driven Recommendations

Leverage artificial intelligence to analyze user behavior and offer personalized suggestions, such as:

- Products or services they’re likely to buy.

- Tailored discounts or promotions.

3. Gamification Elements

Introduce engaging features like:

- Rewards for timely payments.

- Milestone achievements for frequent app usage.

- Leaderboards for the most active users.

Ensuring Security and Trust

Security is non-negotiable in financial apps. If users feel their data is at risk, they’ll quickly abandon your platform.

1. Robust Data Encryption

Protect user information by employing:

- End-to-end encryption for all transactions.

- Secure storage for personal and financial details.

2. Transparent Policies

Clearly communicate your app’s privacy and data-sharing policies to build trust.

3. Two-Factor Authentication (2FA)

Implement 2FA as an additional security layer during login or payment approval.

Streamlining Merchant Integration

A BNPL app like Klarna thrives on merchant partnerships. Simplify the process for businesses to join your platform by:

1. Flexible APIs

Provide easy-to-integrate APIs for merchants to embed BNPL functionality into their checkout systems.

2. Detailed Analytics Dashboards

Offer tools for merchants to track sales, customer behavior, and payment trends.

3. Seamless Checkout Experience

Ensure your BNPL service is integrated seamlessly into the checkout flow, with minimal redirection or interruptions.

Supporting Multilingual and Multi-Currency Capabilities

Expanding your app’s reach to global markets requires inclusivity.

1. Language Options

Include multiple language choices to cater to a diverse user base.

2. Currency Conversion Tools

Enable users to view prices and pay in their preferred currency, complete with accurate exchange rates.

Optimizing for Speed and Accessibility

The modern user expects fast, reliable performance. To enhance usability:

1. Fast Loading Times

Optimize your app’s backend to reduce lag and ensure smooth operation.

2. Offline Mode

Allow users to view past purchases, schedules, or other non-interactive features without internet access.

3. Accessibility Features

Incorporate options for differently-abled users, such as:

- Screen reader compatibility.

- Adjustable text sizes and color contrasts.

Integrating Feedback Loops

Listening to user feedback can help refine your Afterpay clone for long-term success.

1. In-App Feedback Options

Allow users to share their thoughts directly through:

- Surveys.

- Star ratings for features.

- Comment sections for suggestions.

2. Regular Updates

Continuously enhance your app based on feedback to address bugs or introduce new features.

Marketing Your BNPL App for Better Reach

After building a user-friendly BNPL app, ensure it reaches the right audience.

1. Influencer Partnerships

Collaborate with influencers to promote your app to their followers.

2. Social Media Campaigns

Highlight unique features and benefits through targeted ads on platforms like Instagram, TikTok, and Facebook.

3. Referral Programs

Encourage existing users to invite friends by offering incentives like discounts or cashback.

Conclusion

Creating a user-friendly Buy Now Pay Later app requires attention to design, functionality, and security. By prioritizing transparency, personalization, and inclusivity, you can build an app that competes with industry giants like Klarna and Afterpay. From streamlined onboarding to robust security features, every element should contribute to a seamless user experience. With the right strategies, your BNPL app can not only attract users but also foster long-term loyalty.

FAQs

1. What is the main focus of Buy Now Pay Later app development?

The main focus is to provide users with a seamless and secure way to make purchases and pay for them in installments, enhancing convenience and boosting merchant sales.

2. How can a BNPL app like Klarna stand out?

By offering personalized features, transparent payment options, and engaging elements like rewards or gamification. Prioritizing user experience and security is also crucial.

3. Is developing an Afterpay clone profitable?

Yes, creating an Afterpay clone can be highly profitable if you differentiate it with unique features and target markets where BNPL solutions are in demand.

4. How important is security in BNPL apps?

Security is vital, as users share sensitive financial and personal information. Employ robust encryption and authentication methods to protect data and build trust.

5. What are the costs of developing a BNPL app?

Costs vary depending on features, design complexity, and development timelines. Consulting an experienced team can provide a detailed estimate tailored to your goals.