Introduction

The global isocyanate market has witnessed significant growth over the past decade, driven by the rising demand for polyurethane-based products in diverse industries such as automotive, construction, electronics, and furniture. Isocyanates, characterized by their reactive -NCO group, serve as key raw materials in the production of polyurethane foams, elastomers, coatings, adhesives, and sealants. With the expansion of industrialization, infrastructure development, and growing consumer demand for durable and energy-efficient materials, the isocyanate market is poised for further expansion.

This article delves into the dynamics shaping the global isocyanate market, key drivers, market segmentation, competitive landscape, emerging trends, challenges, and future outlook up to 2030.

Market Overview

Isocyanates are broadly classified into three main types: methylene diphenyl diisocyanate (MDI), toluene diisocyanate (TDI), and aliphatic isocyanates. Among these, MDI holds the largest market share, primarily used in rigid polyurethane foams, while TDI is commonly employed in the production of flexible foams for mattresses and furniture. Aliphatic isocyanates are used in specialty applications such as coatings and automotive finishes.

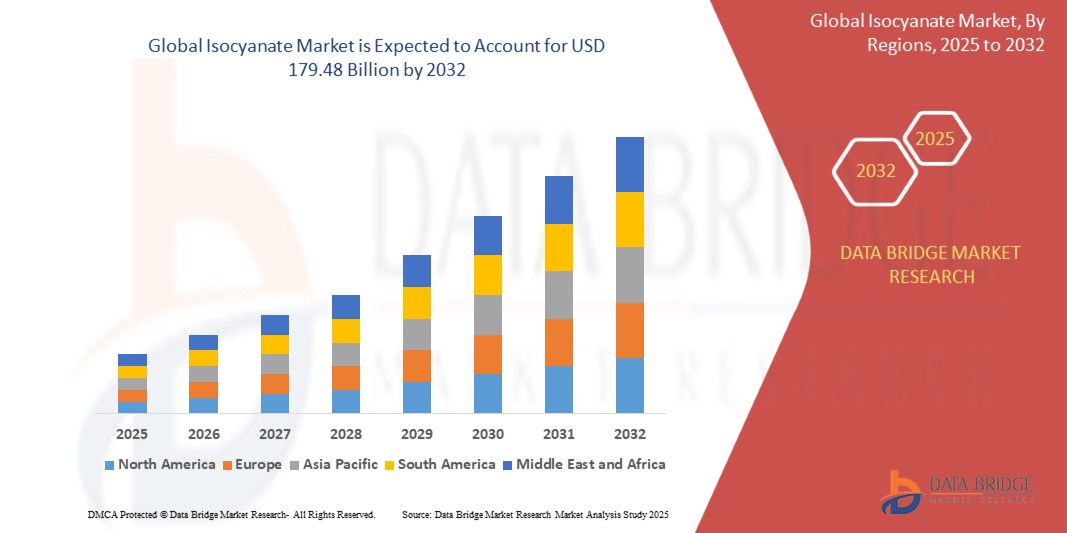

In 2024, the global isocyanate market size was estimated to exceed USD 35 billion, and it is projected to reach around USD 50 billion by 2030, growing at a CAGR of 6-7% during the forecast period.

Key Market Drivers

- Booming Construction and Infrastructure Sector

Rigid polyurethane foams made from isocyanates are widely used in insulation materials due to their excellent thermal performance. With increasing urbanization and construction activities, particularly in emerging economies like India, China, and Brazil, demand for insulation products is rising sharply. - Automotive Industry Expansion

Lightweight, durable polyurethane components are increasingly replacing metal parts to enhance fuel efficiency. Isocyanate-based foams are used in vehicle seats, interiors, and structural parts, contributing to the automotive sector’s demand for isocyanates. - Sustainability and Energy Efficiency

Governments and consumers are more inclined toward energy-efficient and sustainable buildings. Isocyanates used in thermal insulation and low-VOC coatings align with green building standards and energy conservation goals, accelerating their market uptake. - Growth in Consumer Goods and Appliances

Polyurethane foam is a key component in products like mattresses, footwear, cushions, and refrigerators. Rising consumer disposable incomes and evolving lifestyles are driving demand for such products globally.

Market Segmentation

By Type:

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diisocyanate (TDI)

- Aliphatic Isocyanates

By Application:

- Rigid Foam

- Flexible Foam

- Paints & Coatings

- Elastomers

- Adhesives & Sealants

By End-use Industry:

- Building & Construction

- Automotive

- Furniture & Interiors

- Electronics

- Textiles

- Others

Regional Insights

1. Asia-Pacific (APAC)

APAC is the fastest-growing and largest regional market for isocyanates, accounting for more than 40% of the global consumption. Rapid industrialization, infrastructural developments, and the growing automotive sector in China, India, and Southeast Asia are major growth drivers.

2. North America

The United States dominates the North American market due to advanced manufacturing and strong demand for insulation and coatings. Additionally, stringent building codes encouraging energy-efficient materials support market growth.

3. Europe

Europe exhibits moderate growth with increasing emphasis on eco-friendly and sustainable construction materials. Countries like Germany, the UK, and France are significant consumers of polyurethane-based products.

4. Latin America and Middle East & Africa

These regions are witnessing emerging demand due to rising urbanization and infrastructural activities. However, economic fluctuations and regulatory barriers may moderate short-term growth.

Emerging Trends

- Bio-Based Isocyanates

Growing environmental concerns and regulatory pressures are encouraging research into bio-based and low-toxicity isocyanates. Companies are exploring plant-derived feedstocks to reduce reliance on petrochemicals. - Smart Coatings and Advanced Applications

The integration of isocyanates into smart coatings (e.g., self-healing or anti-corrosive) is gaining attention in high-performance industrial applications. - Recycling and Circular Economy

Innovations in chemical recycling of polyurethane products aim to reintroduce recovered isocyanates into the production cycle, aligning with circular economy models. - Technological Innovations in Production

Continuous R&D efforts are leading to improved manufacturing processes with better yield, reduced emissions, and enhanced product properties.

Challenges and Restraints

- Health and Environmental Concerns

Exposure to isocyanates can cause respiratory and skin issues, which has led to stricter safety regulations, particularly in developed nations. This increases compliance costs for manufacturers. - Volatile Raw Material Prices

Isocyanate production heavily relies on petrochemical feedstocks such as benzene and toluene. Fluctuating oil prices and supply chain issues can impact production costs. - Regulatory Hurdles

Regulatory bodies such as REACH (Europe) and EPA (USA) have imposed restrictions on isocyanate handling, affecting small and medium-scale manufacturers and downstream users.

Competitive Landscape

The global isocyanate market is moderately consolidated with the presence of major multinational players investing in R&D, strategic expansions, and sustainable innovations.

Key Players Include:

- BASF SE

- Covestro AG

- Huntsman Corporation

- Dow Inc.

- Wanhua Chemical Group Co., Ltd.

- Mitsui Chemicals, Inc.

- Tosoh Corporation

These players focus on product innovation, mergers & acquisitions, and expanding production capacities to gain a competitive edge in emerging markets.

Future Outlook

The isocyanate market is expected to experience robust growth through 2030, driven by increasing demand for polyurethane-based applications across multiple industries. However, the future trajectory will also depend on how well companies can adapt to evolving regulations, raw material challenges, and the shift toward sustainable solutions.

Key strategic focus areas for stakeholders include:

- Investment in bio-based alternatives.

- Strengthening supply chains to mitigate price volatility.

- Collaboration with downstream industries for customized product development.

- Compliance with global environmental standards to maintain market access.

Conclusion

The isocyanate market stands at a critical juncture where innovation and sustainability are becoming as important as cost-efficiency and performance. As global industries strive for higher efficiency and lower environmental footprints, isocyanate manufacturers must adapt to changing market demands, regulatory landscapes, and technological advancements. With continued investment and strategic collaboration, the isocyanate industry is well-positioned to meet the growing needs of a dynamic global economy.

Read More Details : https://www.databridgemarketresearch.com/reports/global-isocyanate-market