Maximize your startup’s tax savings by identifying key deductions. Learn how an expert accounting and bookkeeping service for startups helps you claim every eligible expense legally and efficiently.

Understand Tax Deductions

Startups face financial difficulties, but savvy accounting can maximize your savings, especially in the area of taxes. Many business owners who are new do not take advantage of significant tax deductions because they don’t have the proper accounting for startups strategy in the first place.

We at Ceptrum Ceptrum, we are experts in startup accounting services aiding entrepreneurs to streamline their finances, minimize tax burdens, and remain legally compliant. If you’re employing Xero accounting software, QuickBooks for small business manually, knowing tax deductions is essential to making more money for your company.

Why Tax Deductions Matter for Startups

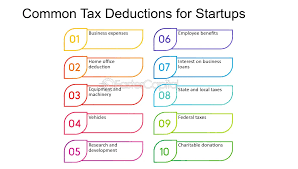

Tax deductions reduce the tax deductible income of your business, which means you pay less taxes and can invest more in the growth of your business. Common deductible expenses include:

- Microsoft Office Supplies & Equipment (computers furniture, software, and computers)

- Marketing and Advertising (digital advertisements or business cards SEO services)

- Salaries and Benefits for Employees (health insurance and bonuses)

- Professional Services (legal charges,tax services for startups Consulting)

- Home Office Expenses (if you work remotely)

How Startup Accounting Services Help Maximize Deductions

1. Accurate Expense Tracking

The mixing of business and personal expenses can be a costly mistake. Small company bookkeeping tools like QuickBooks for small business or Xero accounting software assist in categorizing transactions properly and ensure that no deduction is not taken into consideration.

2. Depreciation & Amortization

Purchases of large amounts (like machines) may be deducted via depreciation. Accounting experts will ensure that you make the most of the deductions you can claim legally.

3. R&D Tax Credits

If your company puts money into innovation you could be eligible for tax credits in R&D–a efficient way to lower tax burdens.

4. Payroll & Contractor Expenses

The wrong classification of employees vs. contractors can result in penalties. The right tax planning for start-ups will ensure compliance while optimizing deductions.

Best Accounting Tools for Startups

| Software | Best For |

| Xero Accounting Software | Cloud-based, automation-friendly |

| QuickBooks for Small Business | It is user-friendly and great for invoicing. |

| FreshBooks | Freelancers and service-based startups |

Ceptrum Ceptrum Ceptrum, we incorporate this technology into startup accounting services to ensure smooth financial management.

Common Mistakes Startups Make with Tax Deductions

Do not keep receipts Digital tools can help however, documentation is crucial.

Do not take home office deductions into consideration If you work at home, you can save a lot of money.

Incorrectly estimating quarterly taxes Beware of penalties by appropriate plan.

Conclusion

Understanding tax deductions is essential for startup success. Whether you’re looking for accounting for startups, tax services for startups, or small company bookkeeping, expert financial management ensures compliance and savings.

Explore Ceptrum’s expert accounting solutions at Ceptrum and optimize your startup’s tax strategy today!