GCC P2P Payment Market Overview:

MarkNtel Advisors recently released a research report focusing on the GCC P2P Payment Market for the forecast period 2024–30. Employing robust methodologies in the research section, the report offers valuable insights into sales and revenue forecasts 2024 to 2030. This approach enhances user understanding and supports well-informed decision-making. The report comprehensively addresses significant changes, gap analyses, emerging opportunities, trends, industry dynamics, and competitive challenges using qualitative and quantitative data. To familiarize established businesses and newcomers with the present market scenario, the report offers detailed growth prospects for the industry and concise insights into competitors.

“In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecasts for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.”

Request For a Free PDF Sample of the Report – https://www.marknteladvisors.com/query/request-sample/gcc-p2p-payment-market.html

GCC P2P Payment Market Insight and Analysis:

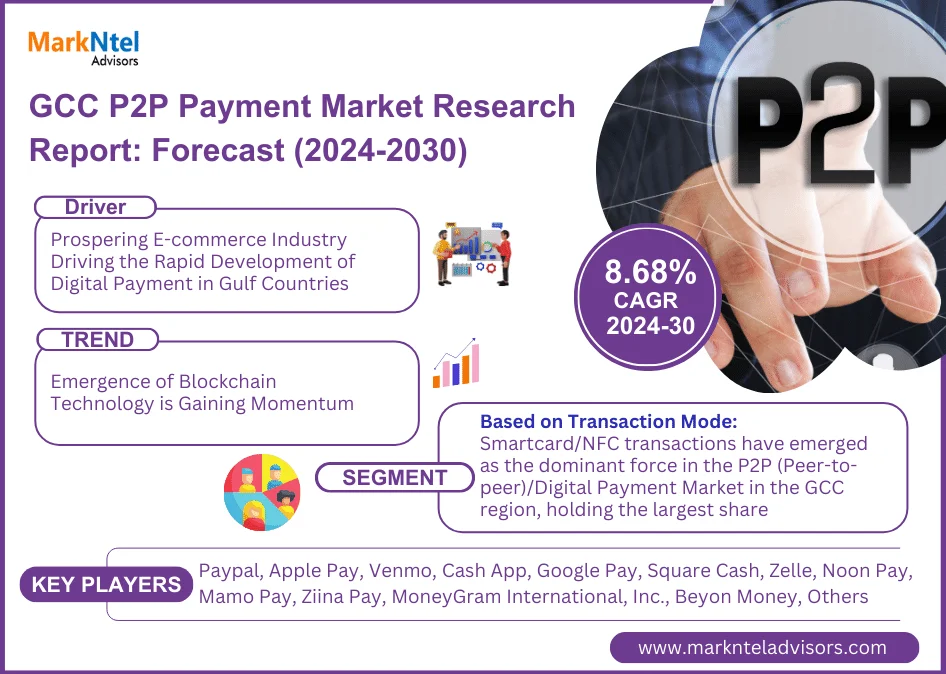

The GCC P2P Payment Market is estimated to grow at a CAGR of around 8.68% during the forecast period, i.e., 2024-30. This extensive report offers a detailed examination of the GCC P2P Payment market, including segmentation, noteworthy trends, market potential, and challenges. The market is segmented into key categories: By Transaction Mode (Short Message Service (SMS), Mobile Apps, Smartcard/NFC (Near field communication), Others (Bank Transfers, Digital Wallets, etc.)), By Location (Remote Payment, Proximity Payment), By End User (Retail & E-Commerce, Travel & Hospitality, Transportation & Logistics, BFSI, Healthcare, Others (IT & Telecom, Media & Entertainment, etc.)), and Others. The report’s reliability is strengthened by a thorough study and analysis utilizing various statistical methodologies.

GCC P2P Payment Market Driver:

Prospering E-commerce Industry Driving the Rapid Development of Digital Payment in Gulf Countries – The surge in the e-commerce industry in GCC countries like the UAE, Saudi Arabia, Kuwait, Bahrain, etc., is fueling a significant transformation of the consumer experience and prompting the rise of digital payments. Several factors have contributed to the buoyant growth of the e-commerce sector in the region. These include the increasing popularity of social commerce & significant investments in infrastructure, such as efficient fulfillment centers, initiatives by the Dubai Free Zones Council, and strategic partnerships, like the collaboration between Noon.com and eBay.

This further underscores effort to capitalize on the expanding market landscape, setting the stage for a promising future for the e-commerce sector in the UAE and the wider GCC region. These factors led to the increasing demand for online shopping, which fueled a surge in the population of online buyers in the GCC, with the number of online shoppers projected to approach 60%. Further, aiding in thriving the Digital Payment Market across the GCC countries.

Browse Full Report With TOC and Latest Market Scope – https://www.marknteladvisors.com/research-library/gcc-p2p-payment-market.html

Analysis of GCC P2P Payment Market leading key players:

A thorough examination of the competitive landscape of the GCC P2P Payment Market involves a comprehensive analysis of its key competitors. This analysis delves deep into each company’s profile, financial achievements, market presence, potential, Research and Development (R&D) expenditures, recent strategic initiatives in the market, footprint, strengths, weaknesses, and market dominance. The information provided offers a comprehensive overview of the leading market players, including Paypal, Apple Pay, Venmo, Cash App, Google Pay, Square Cash, Zelle, Noon Pay, Mamo Pay, Ziina Pay, MoneyGram International, Inc., Beyon Money, Others.

Conclusion:

The report is designed to offer customized solutions that precisely address customers’ unique needs. By thoroughly understanding key growth drivers, businesses can formulate effective strategies, allowing them to navigate the dynamic landscape of any market successfully.

Request Customization – https://www.marknteladvisors.com/query/request-customization/gcc-p2p-payment-market.html

The GCC P2P Payment Market report addresses the following concern:

- The GCC P2P Payment Market report explores the influence of key trends on market share within the primary segments.

- What are the leading market trends that propel the expansion of the GCC P2P Payment market?

- What are the projected CAGR, market size, and growth rate for the GCC P2P Payment Market in the upcoming years?

- What are the key players in the GCC P2P Payment market, and what strategies are they implementing?

- What factors, such as industry trends, drivers, and challenges, are contributing to the growth of the GCC P2P Payment market?

Read More:

- https://reporttok.blogspot.com/2024/11/global-single-use-system-in-biopharma.html

- https://reporttok.blogspot.com/2024/11/armored-vehicles-market-growth-report.html

- https://reporttok.blogspot.com/2024/11/telemedicine-market-growth-report.html

- https://reporttok.blogspot.com/2024/11/automotive-lubricants-market-growth.html

- https://reporttok.blogspot.com/2024/11/global-artificial-intelligence-market.html

About Us:

We are a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Contact Us:

MarkNtel Advisors

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Address Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Email: sales@marknteladvisors.com

Tel No: +1 628 895 8081, +91 120 4278433