Sulfur rarely gets headlines, but in the oil patch, it is serious business. From refining operations to downstream markets, sulfur plays a critical role in how crude oil is processed, regulated, and ultimately monetized. As environmental standards tighten and energy markets evolve, sulfur has shifted from being a troublesome byproduct to a valuable commodity with strategic importance.

Understanding sulfur’s role in the oil industry is no longer optional. For producers, refiners, traders, and industrial buyers, sulfur sits at the intersection of compliance, efficiency, and opportunity.

Sulfur’s Natural Link to Crude Oil

Most crude oil contains sulfur in varying concentrations. These sulfur compounds, collectively referred to as sulfur oil when present in petroleum streams, must be removed during refining to meet fuel specifications and emissions standards.

High-sulfur crudes, often labeled as “sour,” require more intensive processing than low-sulfur “sweet” crudes. This difference directly affects refinery complexity, operating costs, and product yields. As a result, sulfur content is a key factor in crude pricing and refinery economics.

Rather than treating sulfur as waste, modern refining has turned sulfur recovery into a standard and profitable operation.

From Byproduct to Marketable Commodity

Advances in refining technology, particularly the Claus process and tail gas treatment units, allow refiners to recover elemental sulfur efficiently. What was once an environmental liability is now a marketable product used across multiple industries.

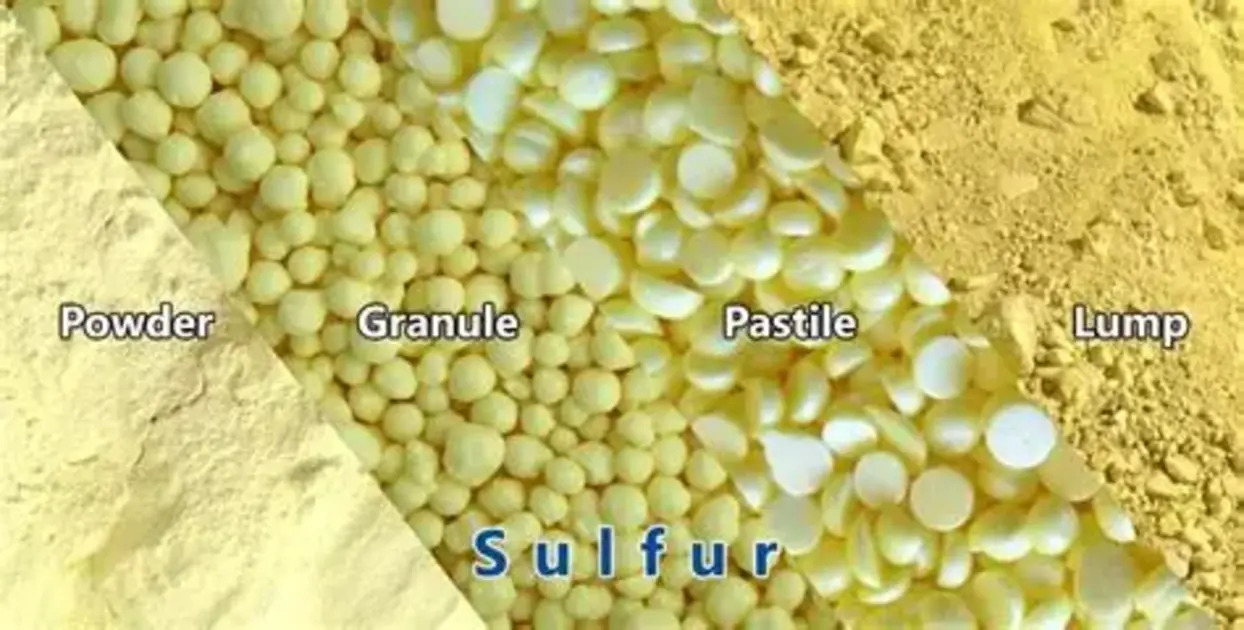

Recovered sulfur is typically sold in solid or liquid form and shipped globally. Major producing regions often align with major refining hubs, creating a steady supply chain tied directly to oil production levels.

This transformation has made sulfur oil recovery an essential part of refinery design and long-term investment planning.

Environmental Regulations Drive Demand

Stricter environmental regulations have increased sulfur’s importance throughout the oil value chain. Fuel sulfur limits, such as those imposed on gasoline, diesel, and marine fuels, require deeper desulfurization at the refinery level.

At the same time, sulfur recovery reduces sulfur dioxide emissions, a major contributor to acid rain and air pollution. Compliance is not optional. Refineries that fail to manage sulfur effectively face regulatory penalties, operational shutdowns, and reputational risk.

In this context, sulfur management is both an environmental obligation and a commercial necessity.

Key Uses of Sulfur Products

Sulfur recovered from oil refining feeds a wide range of industrial applications. The most significant include:

- Fertilizer production: The majority of elemental sulfur is converted into sulfuric acid, a core input for phosphate fertilizers.

- Chemical manufacturing: Sulfur derivatives are used in detergents, pigments, explosives, and pharmaceuticals.

- Metallurgy: Sulfuric acid plays a role in mineral processing and metal extraction.

- Energy and construction: Sulfur-based products are used in batteries, asphalt modification, and concrete applications.

These downstream markets create steady demand, linking sulfur oil recovery directly to global economic activity.

Sulfur Pricing and Market Volatility

Sulfur prices are influenced by both energy markets and agricultural demand. When oil production rises, sulfur supply increases. When fertilizer demand spikes, sulfur prices often follow.

This dynamic creates periods of oversupply and tight markets, making sulfur trading an increasingly sophisticated business. Producers and traders who understand sulfur market cycles can capture additional value beyond core oil revenues.

For oil companies, sulfur is no longer just a cost center. Managed correctly, it becomes a revenue stream that offsets refining expenses.

Operational Challenges in Sulfur Handling

Despite its value, sulfur presents unique handling challenges. Molten sulfur requires temperature control. Solid sulfur must be stored and transported carefully to prevent contamination, degradation, or safety hazards.

Investments in sulfur forming, storage, and logistics infrastructure are essential. Poor sulfur handling can negate its commercial value and create operational bottlenecks.

This is where specialized sulfur products, additives, and handling solutions play a vital role in maintaining quality and maximizing returns.

Strategic Importance for the Oil Patch

As the energy industry navigates the transition toward lower emissions and higher efficiency, sulfur remains deeply embedded in oil patch economics. Even as fuel standards tighten and alternative energy grows, oil refining will continue to generate sulfur for decades.

Companies that treat sulfur oil recovery and sulfur product management as strategic functions, rather than afterthoughts, are better positioned to compete. This includes investing in reliable sulfur recovery systems, developing strong off-take agreements, and aligning sulfur products with high-demand markets.

Practical Takeaways for Industry Players

For operators across the oil patch, several practical lessons stand out:

- Treat sulfur as a product, not waste.

- Align sulfur recovery capacity with long-term production plans.

- Monitor sulfur markets alongside crude and refined products.

- Invest in quality control, storage, and logistics for sulfur products.

- Partner with experienced sulfur product suppliers to reduce risk.

Sulfur may not be glamorous, but it is indispensable. In today’s oil patch, sulfur is not just part of the process. It is part of the business.

More info visit: toko belerang – BELIRANGKALISARI