Have you ever tried to check your CIBIL score for free and noticed a long, unique number printed at the top of your report? That string of digits isn’t random—it’s called the control number in CIBIL, and it plays a surprisingly important role. Imagine it as the identification tag for your credit profile—just like your Aadhaar number or passport helps verify your identity, this control number helps credit bureaus and lenders locate your credit report instantly.

Think of it this way: when a lender checks your creditworthiness, they don’t need to sift through millions of records. Instead, they use this unique control number to pull up your exact report in seconds (and here’s why understanding it matters if you ever plan to borrow).

Let’s explore what this number means, where to find it, and how it ties into checking and improving your credit score.

Understanding What the Control Number in CIBIL Is

In simple terms, the control number in CIBIL is an exclusive 9-digit identification code assigned to every credit report generated by TransUnion CIBIL. Each time your credit report is pulled—whether by you or by a lender—a new control number is generated.

This number acts as a reference point. So, instead of sharing your personal details each time, you can simply provide the control number to a bank or financial institution, and they can directly access your specific credit report.

(Think of it like sharing a document reference instead of resending the entire file—it saves time and keeps things accurate.)

Where to Find the Control Number in CIBIL

Locating your control number is easy once you know where to look. When you check CIBIL score for free or access your credit report online, the control number is usually displayed at the top of the report, right below your name and personal details.

Here’s a quick snapshot for reference:

| Section | Details Found |

|---|---|

| Report Header | Name, date of birth, address |

| Control Number | 9-digit code (unique for each report) |

| CIBIL Score | Numeric score between 300 and 900 |

| Account Information | Loan and credit card history |

| Enquiry Details | Recent lender enquiries |

If you’re reviewing your report after you check CIBIL online, make sure to note down this control number. It’s particularly useful when you need to raise a dispute, verify data, or contact customer support.

Why the Control Number Matters

At first glance, the control number may seem like just another technical detail—but it serves several practical purposes:

- Quick Reference for Lenders – Instead of searching by your name or PAN, lenders can instantly retrieve your report using the control number.

- Efficient Issue Resolution – If you raise a dispute about any incorrect entry, the CIBIL support team uses this number to track and update the specific report.

- Secure Identification – The number ensures your credit details are shared safely, without revealing unnecessary personal information.

Simply put, it’s your credit report’s unique fingerprint—no two are ever the same.

How to Check and Calculate Your CIBIL Score

While the control number helps identify your credit report, your CIBIL score itself reflects your financial behaviour. If you want to know how lenders view you, you can easily check CIBIL score for free on authorised websites or directly check CIBIL online through the official CIBIL portal.

Here’s how you can do it:

| Step | Action | Purpose |

|---|---|---|

| Step 1 | Visit the CIBIL website or trusted credit platform | To access your score securely |

| Step 2 | Enter details (name, date of birth, PAN, etc.) | For verification |

| Step 3 | Authenticate via OTP/email | To confirm identity |

| Step 4 | View report and calculate your CIBIL score | Instantly see your score and control number |

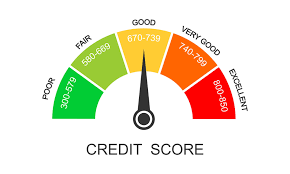

Once you have your score, you’ll notice it ranges between 300 and 900—the higher it is, the better your creditworthiness. Scores above 750 are generally considered excellent and improve your chances of loan approval at better interest rates.

Relationship Between Control Number and Credit Score

Your control number in CIBIL and your CIBIL score are linked—but they serve different purposes. The control number is like the address of your credit report, while the score is the summary of your financial credibility.

When you apply for a loan or a credit card, lenders use your control number to retrieve your report and review your CIBIL score. So, both are important—one helps locate your data, the other helps evaluate it.

(Think of the control number as the key, and the credit score as what lies inside the door.)

Tips to Improve Credit Score Over Time

If your score isn’t where you want it to be, don’t worry—you can always improve credit score gradually with the right financial habits.

Here’s how you can start:

- Pay EMIs and credit card bills on time—delays can pull your score down.

- Keep your credit utilisation ratio below 30%—it signals financial discipline.

- Avoid too many credit applications in a short time—it shows desperation for funds.

- Regularly check CIBIL score for free to monitor improvements or detect errors.

- Retain older credit cards—they add length to your credit history.

Improving your score isn’t an overnight process—it’s more like maintaining a garden. With patience and consistency, your financial profile will flourish.

When to Use Your Control Number

You’ll find the control number in CIBIL especially useful when:

- A lender requests your credit report reference.

- You raise a complaint or dispute with CIBIL.

- You download multiple reports and need to identify the latest one.

Having this number handy makes every interaction smoother, whether you’re discussing loan eligibility or resolving discrepancies.

Wrapping Up — Why the Control Number in CIBIL Is Worth Noticing

To sum up, the control number in CIBIL might seem like a technical detail, but it’s an essential identifier that simplifies how lenders, borrowers, and CIBIL communicate. It helps track your credit report precisely, ensures security, and speeds up problem resolution.

At the same time, taking a few minutes to check CIBIL online, calculate your CIBIL score, and adopt habits that improve credit score can make a world of difference to your financial journey.

Imagine this—your credit report tells your story, and the control number is the index that keeps every chapter in order. The answer to better financial health is simple—if you know where to look and how to use it.